Maharashtra Cyber Cell has summoned several individuals, including Tanmay Bhat, Rakhi Sawant, Uorfi Javed, Siddhant

The Republic Day Parade in India is always a grand and highly anticipated event, and

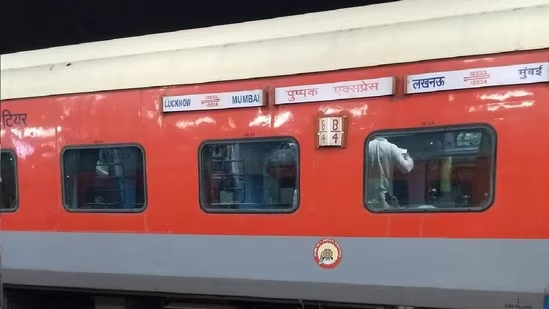

On January 22, 2025, a tragic incident occurred near Pardhade railway station in Jalgaon district, Maharashtra. Passengers aboard the Pushpak Express, traveling from Lucknow to Mumbai, noticed smoke emanating from the train’s wheels, leading to panic and fears of a fire. In response, several passengers pulled the emergency chain and disembarked onto the adjacent tracks. Tragically, at that moment, the Bengaluru Express (also referred to as the Karnataka Express) was approaching on the adjacent track and struck the passengers who had alighted, resulting in multiple fatalities.

HINDUSTAN TIMES

Initial reports indicate that at least six individuals lost their lives in the accident.

THE TRIBUNE

However, some sources suggest the death toll could be as high as eight.

THE INDIAN EXPRESS

Additionally, several passengers sustained injuries and were promptly transported to nearby hospitals for medical attention.

The incident has prompted an immediate response from railway authorities and local officials. The Divisional Railway Manager of Bhusawal, along with a medical team, has been dispatched to the site to oversee rescue and relief operations. The exact cause of the smoke, which led to the panic among passengers, is under investigation. Preliminary assessments suggest that the smoke may have resulted from either a ‘hot axle’ or ‘brake-binding’ (jamming).

THE NEW INDIAN EXPRESS

Uttar Pradesh Chief Minister Yogi Adityanath has expressed deep sorrow over the incident and has directed officials to ensure adequate medical treatment for the injured.

HINDUSTAN TIMES

Further investigations are underway to determine the precise sequence of events and to implement measures to prevent such tragedies in the future.

The Securities and Exchange Board of India (SEBI) is actively considering the introduction of a platform to facilitate the trading of shares allotted in an Initial Public Offering (IPO) before their official listing on stock exchanges. This initiative aims to regulate and legitimize the currently unregulated grey market activities that occur during the typical three-day interval between share allotment and formal listing.

MONEYCONTROL

SEBI Chairperson Madhabi Puri Buch highlighted the prevalence of curb trading in this interim period and emphasized the need for a structured mechanism to allow such transactions within a regulated framework. She stated, “Between the three days when the shares are allotted to the time the shares start trading, there is a lot of curb trading. If investors want to do this, why not give them the same opportunity in a properly regulated space.”

MONEYCONTROL

The proposed “when-listed” securities trading would enable investors to trade shares after the IPO closure but before their official listing. This move is expected to enhance transparency and protect investor interests by bringing pre-listing transactions under regulatory oversight.

INC42

This development comes in the context of a robust IPO market in India. In 2024, the country witnessed a significant surge in IPOs, with 91 large firms going public and raising a record 1.6 trillion rupees ($18.5 billion).

REUTERS

SEBI’s initiative to allow pre-listing trading is part of its broader efforts to curb unregulated market activities and ensure a fair and transparent trading environment for investors.

Zomato, India’s leading food delivery platform, reported its financial results for the third quarter ending

Donald Trump was sworn in today as the 47th President of the United States, marking his second, non-consecutive term in office. The inauguration ceremony took place indoors at the U.S. Capitol Rotunda due to extreme cold weather, a setting last used 40 years ago.

REUTERS

In his inaugural address, President Trump pledged to end what he termed “four long years of American decline,” promising a new era of “American strength and prosperity.” He outlined plans to sign approximately 200 executive orders immediately, targeting issues such as border security, immigration, and energy policies. Specific actions include declaring a national emergency at the U.S.-Mexico border and classifying drug cartels as foreign terrorist organizations.

THE TIMES

The ceremony was attended by notable figures, including outgoing President Joe Biden and First Lady Jill Biden, who hosted the Trumps at the White House prior to the event. All living former U.S. presidents—Bill Clinton, George W. Bush, and Barack Obama—were present, along with their spouses, except for Michelle Obama. India was represented by External Affairs Minister S. Jaishankar.

HINDUSTAN TIMES

Security measures were heightened due to recent political violence, including assassination attempts on President Trump. Despite the cold weather and indoor relocation, the inauguration proceeded smoothly, marking a historic moment as Trump becomes the first president since Grover Cleveland to serve non-consecutive terms.

As of January 19, 2025, TikTok has been removed from U.S. app stores and is currently inaccessible to its 170 million American users due to a federal ban.

THE SCOTTISH SUN

This action follows the Supreme Court’s decision to uphold the Foreign Adversary Controlled Applications Act, which mandates that TikTok’s Chinese parent company, ByteDance, divest its U.S. operations by January 19 to address national security concerns.

BARRON’S

In response to the ban, President-elect Donald Trump has indicated he will “most likely” grant a 90-day extension after taking office on January 20, allowing ByteDance additional time to negotiate a sale to a U.S.-based entity.

NPR

Despite this potential reprieve, TikTok preemptively disabled its services in the U.S., notifying users of the app’s temporary unavailability.

THE VERGE

The uncertainty surrounding TikTok’s future has prompted many users to seek alternative platforms. Apps such as RedNote (also known as Xiaohongshu), Lemon8, Clapper, and Flip have experienced a surge in downloads as users migrate to new spaces for content creation and sharing.

CNN

This migration has led to the viral use of the hashtag “#tiktokrefugee” among communities adapting to these new platforms.

WIKIPEDIA

While the potential 90-day extension offers a glimmer of hope for TikTok’s return, the platform’s future in the U.S. remains uncertain. Users and creators are advised to stay informed about developments and consider diversifying their online presence across multiple platforms to mitigate the impact of such disruptions.

Samsung is set to unveil the Galaxy S25 series—including the Galaxy S25, S25 Plus, and S25 Ultra—at the Galaxy Unpacked event on January 22, 2025. Ahead of the official launch, leaked information has surfaced regarding the pricing and pre-reservation benefits for these devices.

Leaked Pricing in India:

According to reports, the Galaxy S25 series is expected to be priced higher than its predecessor, the Galaxy S24 series, in the Indian market. The anticipated prices are as follows:

Galaxy S25:

12GB RAM + 256GB Storage: ₹84,999

12GB RAM + 512GB Storage: ₹94,999

Galaxy S25 Plus:

12GB RAM + 256GB Storage: ₹1,04,999

12GB RAM + 512GB Storage: ₹1,14,999

Galaxy S25 Ultra:

12GB RAM + 256GB Storage: ₹1,34,999

16GB RAM + 512GB Storage: ₹1,44,999

16GB RAM + 1TB Storage: ₹1,64,999

These prices indicate an approximate increase of ₹5,000 across all models compared to the Galaxy S24 series. The price hike is attributed to the integration of the advanced Snapdragon 8 Elite chipset, which enhances performance but also raises production costs.

GSMARENA

Pre-Reservation Benefits:

Samsung is offering incentives for customers who pre-reserve the upcoming Galaxy S25 devices. By registering on Samsung’s official website or through the Shop Samsung app before January 22, 2025, customers can secure a $50 credit applicable toward additional devices or accessories (excluding the phone itself). Additionally, a $100 credit is available for those pre-ordering eligible 2025 TVs or audio products using the same email address.

THE VERGE

Furthermore, there are reports suggesting that the Galaxy S25 series may come with a complimentary one-year subscription to Gemini Advanced, Google’s AI service comparable to ChatGPT Premium. This subscription, typically priced at €21.99 per month, would offer users access to Google’s most advanced AI models, integrated seamlessly with Samsung’s Galaxy AI.

CINCO DÍAS

Design and Features:

Leaked official images reveal design enhancements in the Galaxy S25 lineup. The Galaxy S25 Ultra is expected to feature rounded corners and camera rings matching the frame, maintaining a quad-camera setup with optical improvements. The Galaxy S25 and S25 Plus are anticipated to have slimmer bezels and color-coordinated camera modules. All models are likely to be powered by the Snapdragon 8 Elite processor, equipped with 120Hz displays, and run on Android 15 with Samsung’s One UI 7.

CINCO DÍAS

Please note that these details are based on leaks and unofficial reports. For confirmed information, it is advisable to await Samsung’s official announcement during the Galaxy Unpacked event.

Apple has temporarily suspended its AI-generated news summary feature in the iOS 18.3 beta software due to inaccuracies in the generated content. This decision affects iPhones, iPads, and Mac computers running the beta versions.

The suspension follows complaints from media organizations, notably the BBC, which reported that Apple’s AI-generated summaries were producing false news alerts. In one instance, the AI incorrectly summarized a BBC report, leading to a misleading notification.

Apple has acknowledged these issues, often referred to as “hallucinations” in AI terminology, and is working to improve the accuracy of its AI summarization technology. The company plans to reintroduce the feature in a future software update once the problems are resolved.

This incident highlights the challenges tech companies face in implementing AI technologies without compromising information accuracy. Similar issues have been encountered by other companies, such as Google, which had to adjust its AI-driven search engine to address accuracy concerns in the past year.

India Squad Announcement For Champions Trophy 2025, LIVE Updates: Mohammed Shami Returns, Big Stars Miss